Unveiling the Financial Canopy:

A Comprehensive Acorns Review

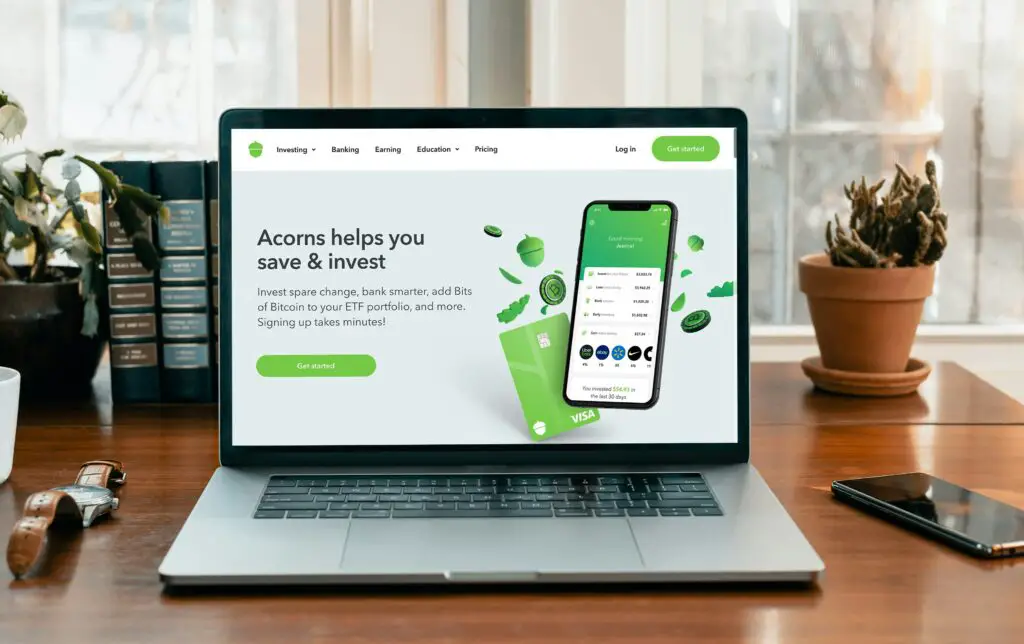

Embarking on a journey toward financial prosperity is akin to traversing an intricate forest, filled with a myriad of investment options, each bearing its unique allure. Nestled within the foliage is Acorns, a financial platform that beckons with promises of effortless wealth cultivation. In this detailed exploration, we peel back the leaves to uncover the essence of Acorns – its origin, the mechanics of its growth, and the shade it casts upon the financial landscape.

The Germination:

A Glimpse into Acorns’ Roots

In the dense jungle of fintech, Acorns stands as a sturdy sapling with roots dating back to 2012. Born from the visionary minds of Walter and Jeff Cruttenden, this financial platform germinated from the idea that even the smallest acorn has the potential to grow into a mighty oak. The ethos? Harnessing the power of micro-investing, Acorns sought to democratize wealth creation, making it accessible to every individual, irrespective of their financial acumen.

The initial stages of Acorns were akin to the delicate sprouting of a seed. It began as a spare-change investing app, rounding up everyday transactions to the nearest dollar and funneling the spare cents into a diversified portfolio of Exchange-Traded Funds (ETFs). A groundbreaking concept that turned mundane transactions into seeds for a future forest of financial security.

Nurturing the Foliage:

Features and Functionality

As Acorns grew from seedling to sapling, it developed a robust set of features to provide its users with a lush, user-friendly financial ecosystem. The ‘Round-Ups’ feature, akin to raindrops nourishing the soil, effortlessly accumulates spare change, ensuring that no financial droplet goes to waste. This micro-investing strategy allows even the smallest of financial contributions to grow steadily over time.

The ‘Found Money’ feature, akin to discovering hidden treasures in the forest, introduces a unique twist. Acorns has partnered with various brands and businesses, redirecting a percentage of your purchases back into your investment portfolio. It’s a symbiotic relationship – you spend, and the forest of your finances flourishes. Additionally, the ‘Acorns Later’ feature extends a branch into the future, offering Individual Retirement Accounts (IRAs) to ensure a secure financial canopy for the later years.

The Branches:

Investment Portfolios Unveiled

Delving into the heart of Acorns, we discover the diverse branches of investment portfolios, each tailored to cater to different risk appetites. The ‘Core’ portfolios, reminiscent of the sturdy trunk of an oak, offer a balanced mix of ETFs, blending stocks and bonds to provide stability and growth. For those with a penchant for socially conscious investing, the ‘Socially Responsible’ portfolios unfurl like leaves, embodying a commitment to ethical and sustainable practices.

Venturing deeper into the financial thicket, we encounter ‘Aggressive’ and ‘Moderately Aggressive’ portfolios, designed for the bold explorer seeking higher returns and willing to weather the storms of market volatility. These branches are not for the faint of heart but promise the exhilaration of soaring to new financial heights.

The Ecosystem:

Acorns’ Mobile Arboretum

In the age of smartphones, Acorns has ingeniously cultivated a thriving mobile arboretum, providing users with a seamless interface to tend to their financial foliage. The app, a virtual forest glade, beckons with its intuitive design, allowing users to effortlessly navigate through their investment landscapes. It’s not merely an app; it’s a dynamic ecosystem that transforms financial management into a visually captivating experience, ensuring that users remain engaged and invested in the growth of their financial forest.

The ‘Acorns Later’ retirement planner, a hidden grove within the app, allows users to chart their course toward a prosperous future. With tools to project retirement savings and optimize contributions, this feature serves as a compass, guiding users through the twists and turns of the financial wilderness.

Weathering the Storm:

Acorns’ Security Measures

In the sprawling expanse of the financial forest, security is paramount. Acorns, like the vigilant guardian of a sacred grove, employs robust security measures to safeguard the financial wellbeing of its users. Bank-level encryption shields sensitive information from prying eyes, ensuring that your financial seeds are protected from the predation of digital wolves.

Furthermore, Acorns implements multi-factor authentication, an additional layer of defense akin to a thorny thicket guarding against unauthorized access. It’s a fortress of financial security, ensuring that your investments are cocooned within layers of digital armor, sheltered from the tempestuous winds of the online world.

The Canopy’s Whisper:

Customer Support and User Experience

In the midst of this financial canopy, the whispering leaves are the testimonials of satisfied users. Acorns prides itself on a responsive and attentive customer support team – the silent guardians of the forest. Whether you’re grappling with the complexities of investing or merely seeking guidance, Acorns’ support team is a beacon, illuminating the path toward financial clarity.

The user experience, akin to the dappled sunlight filtering through the leaves, is designed for accessibility. Acorns employs a minimalist aesthetic, ensuring that users are not overwhelmed by the complexities of the financial ecosystem. From the initial onboarding to the ongoing nurturing of your financial portfolio, the user experience is crafted with the finesse of a seasoned horticulturist.

The Evergreen Promise:

Acorns’ Continued Growth

As we conclude our journey through the flourishing landscape of Acorns, it’s evident that this financial platform is not merely a seasonal bloom but an evergreen promise. The acorn, once a humble seed, has burgeoned into a mighty oak, providing shade and sustenance to those who tend to their financial groves. Acorns, with its innovative approach to micro-investing, has carved a niche in the fintech ecosystem, offering a compelling avenue for individuals to cultivate their financial futures.

In the ever-evolving financial wilderness, Acorns remains a constant, its roots firmly anchored in the soil of accessibility and innovation. The story of Acorns is not just about numbers and percentages; it’s a narrative of empowerment, enabling individuals to sow the seeds of financial prosperity and witness the gradual but steadfast growth of their personal financial forest.