Unveiling the Finest Free Investing Apps:

Navigating the Modern Financial Frontier

Embarking on the journey of financial growth and investment can be both thrilling and daunting. The world of investing has evolved, breaking barriers and democratizing access for everyone. In this era of technological marvels, free investing apps have become the trusted allies for both seasoned investors and newcomers alike. In this exploration, we uncover the crème de la crème of these apps, each wielding its unique strengths to empower users on their financial odyssey.

Robinhood:

Liberating the Trade Winds

Amidst the hustle and bustle of the financial markets, Robinhood emerges as a maverick, challenging the traditional norms of investing. With its sleek interface and user-friendly design, Robinhood welcomes both the seasoned trader and the curious novice. The platform’s hallmark is its commission-free trading, allowing users to sail through the stock market without the burden of transaction fees.

Navigating Robinhood is akin to steering a sleek vessel through the choppy waters of Wall Street. The app’s intuitive design ensures that even those new to investing can confidently explore and execute trades. It’s a financial adventure, where every tap on the screen is a calculated move toward wealth-building. Robinhood’s real-time market data and customizable watchlists provide a dynamic compass, helping users seize opportunities as they arise.

However, like any journey, risks accompany the rewards. Robinhood has faced scrutiny for its gamification elements, enticing users with flashy features. As with any tool, wielding it wisely is paramount. Robinhood stands as a testament to the evolution of investing, inviting all to partake in the excitement of financial seas.

Wealthfront:

A Symphony of Automated Wisdom

In the symphony of investment possibilities, Wealthfront’s notes resonate with the precision of an automated maestro. This robo-advisor app brings the elegance of artificial intelligence to the realm of personal finance. Wealthfront’s modus operandi involves crafting a personalized investment portfolio based on individual goals, risk tolerance, and time horizon.

The allure of Wealthfront lies in its hands-free approach. Users surrender the baton to the robo-advisor, allowing algorithms to conduct a harmonious blend of diversified investments. The app’s automatic rebalancing ensures that the composition of the portfolio remains in tune with market fluctuations. This isn’t just investing; it’s entrusting your financial symphony to an algorithmic conductor.

Wealthfront’s commitment to minimizing fees adds a crescendo to its appeal. With no advisory fees for the first $5,000 and a management fee that undercuts traditional financial advisors, the platform provides a cost-effective ticket to the world of automated wealth management. The soothing melody of Wealthfront lies in its ability to simplify the complexities of investing, transforming it into an accessible art form for all.

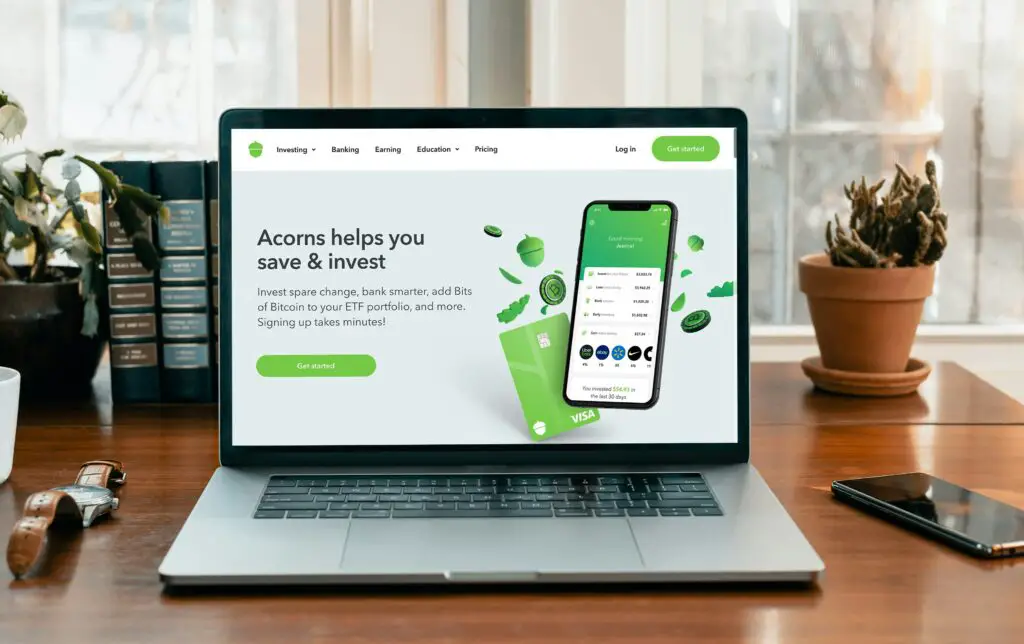

Acorns:

Harvesting Pennies for a Bountiful Future

In the vast orchard of financial opportunities, Acorns stands as a unique cultivator, encouraging users to sow the seeds of wealth from their everyday transactions. This micro-investing app operates on the principle of rounding up everyday purchases to the nearest dollar and investing the spare change. The brilliance lies in the simplicity of the concept – transforming small, seemingly inconsequential amounts into a flourishing investment portfolio.

Acorns is a financial gardener, tending to the growth of your money with a meticulous touch. Its diversified portfolio options cater to different risk appetites, allowing users to tailor their investment strategy. The app’s “Found Money” feature further enriches the soil, offering cashback rewards from partnered brands that seamlessly integrate with your investment account.

However, beneath the lush canopy of Acorns, challenges emerge. Critics argue that the fees, especially for smaller accounts, can erode the returns. Yet, the essence of Acorns lies not in amassing great fortunes overnight but in nurturing the habit of consistent investment. It’s a testament to the power of incremental growth, transforming spare change into a flourishing financial ecosystem.

M1 Finance:

Crafting Your Financial Tapestry

In the realm of investment, M1 Finance emerges as an artisan, allowing users to craft a bespoke financial tapestry. This hybrid platform seamlessly combines the flexibility of a brokerage with the automation of a robo-advisor. M1 Finance empowers users to create “Pies,” personalized portfolios that can be as diverse or as focused as one desires.

Navigating M1 Finance is akin to being an artist in a studio, selecting and arranging different “slices” of investments to form a masterpiece. The platform’s unique approach allows for both hands-on customization and the ease of automated rebalancing. It’s a canvas where financial aspirations come to life, and every investment is a stroke that contributes to the overall masterpiece.

However, the palette of M1 Finance is not without its nuances. While the platform offers the freedom to curate one’s investment strategy, the learning curve might be steeper for those new to the world of financial artistry. Yet, for those willing to explore the nuances of their financial palette, M1 Finance is a playground where creativity meets wealth creation.

In the grand tapestry of free investing apps, each player brings a unique melody to the symphony of financial empowerment. Whether sailing the seas of commission-free trading with Robinhood, conducting a harmonious orchestra of investments with Wealthfront, cultivating wealth through spare change with Acorns, or crafting a bespoke financial masterpiece with M1 Finance, these apps redefine the landscape of personal finance. As we traverse this modern frontier, may these tools serve as compasses, guiding us towards the shores of financial prosperity.